-

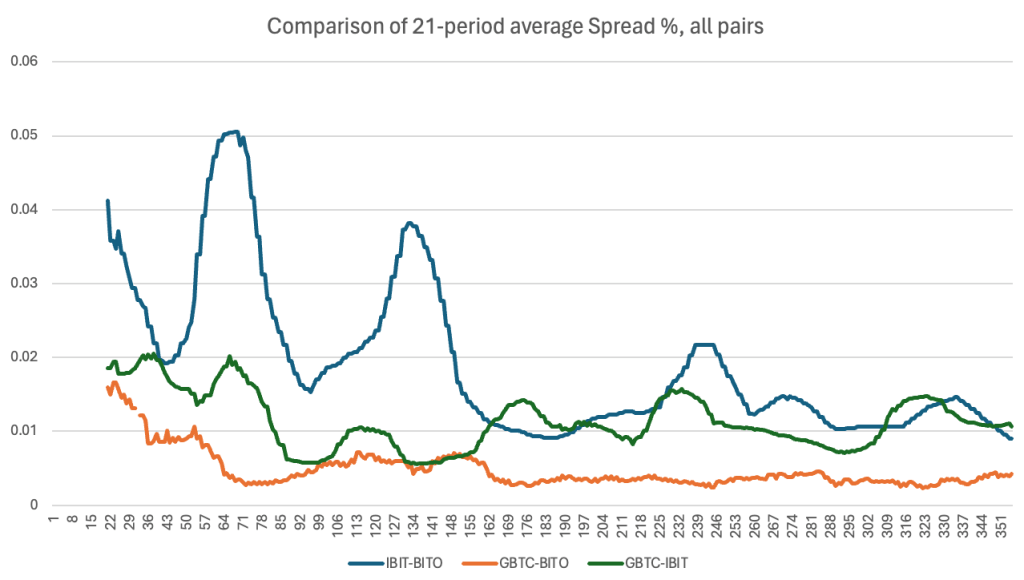

Pairs Trading Bitcoin Spot Products

I’ll admit I meant to get this post out before February, but life got in the way (in a good way!) There’s been a bit of Crypto-related news coverage recently, specifically on the approval of Bitcoin Spot ETF’s on Jan 10th. No matter your opinions on cryptocurrencies, the SEC approval is a big deal even… Read more

-

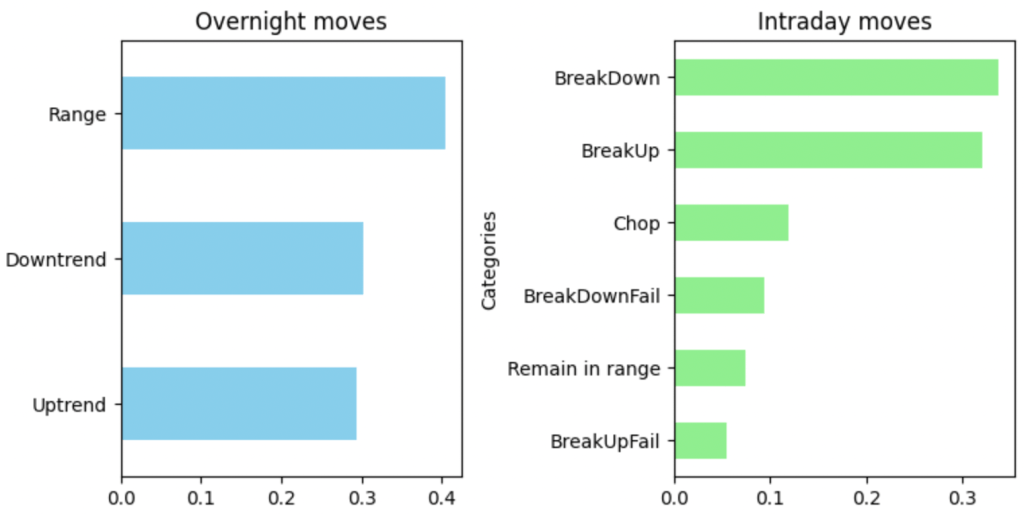

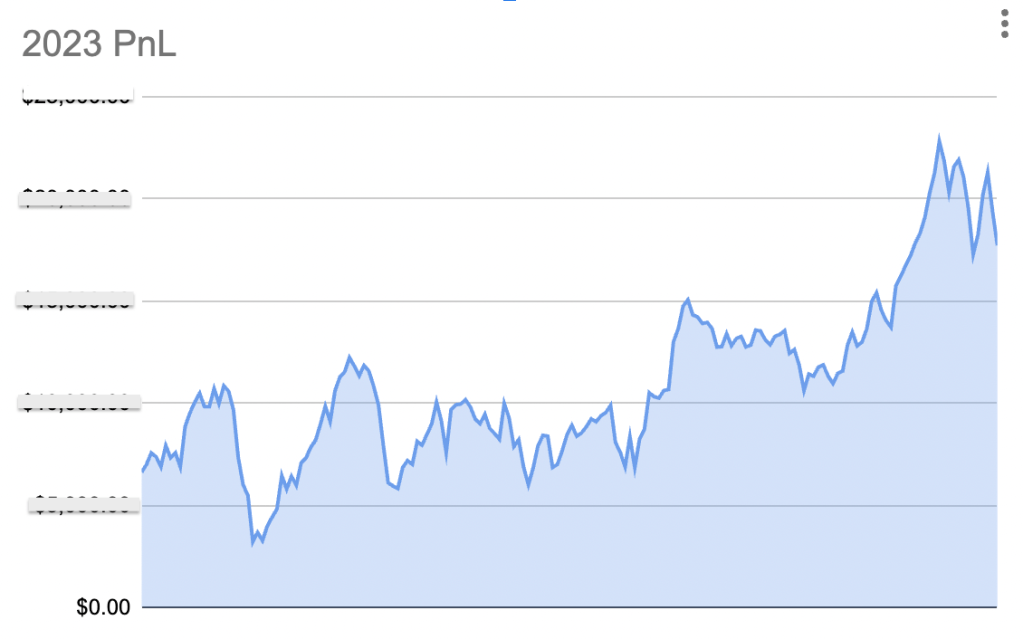

My Year in Trading: 2023

Happy New Year! Today’s post is less technical than usual – I’ll be reviewing my personal (non-algorithmic) trading stats and metrics for 2023. It was my first ever year trading full time/ professionally. I worked for a proprietary trading firm from mid 2022 until April 2023, and continued trading independently while pursuing post-grad education after… Read more

-

Consulting Updates

We are thrilled to share some exciting news with you… In addition to continuing our specialized algorithmic trading services, we are expanding our horizons by introducing a broader range of services in data analysis and consulting. This will allow us to serve an even wider clientele with an array of offerings such as advanced statistical… Read more

-

Poker Theory in Trading

I’m currently interviewing at a quantitative trading firm that heavily incorporates poker theory into their trading philosophy. I find this uniquely fascinating, so I’ve decided to explore it a bit in this post. Poker and trading might seem like completely different worlds, but beneath their surface differences lie some striking similarities. Both are games of… Read more

-

Design philosophy for market-tracking strategies

The objective of any trading strategy is to differentiate itself from the market in terms of volatility, return, or diversity. Today, I will focus on strategies that aim to outperform the market’s return while reducing volatility. The conventional approach to strategy development involves analyzing price movements using data and selecting statistical or fundamental factors that,… Read more

Subscribe!

Enter your email below to receive updates.